Regional cross-border investment in commercial real estate ( CRE ) more than doubled in Q1 2025, rising 116.7% year-on-year to US$9.5 billion, according to a recent report.

This sharp increase stands out amid persistent global economic volatility and uncertainty around Trump’s tariff policies, according to property group Knight Frank’s latest Asia-Pacific Capital Markets Insights report, and this reflects renewed investor confidence in the region’s real estate fundamentals, with Japan, Australia and South Korea emerging as key destinations.

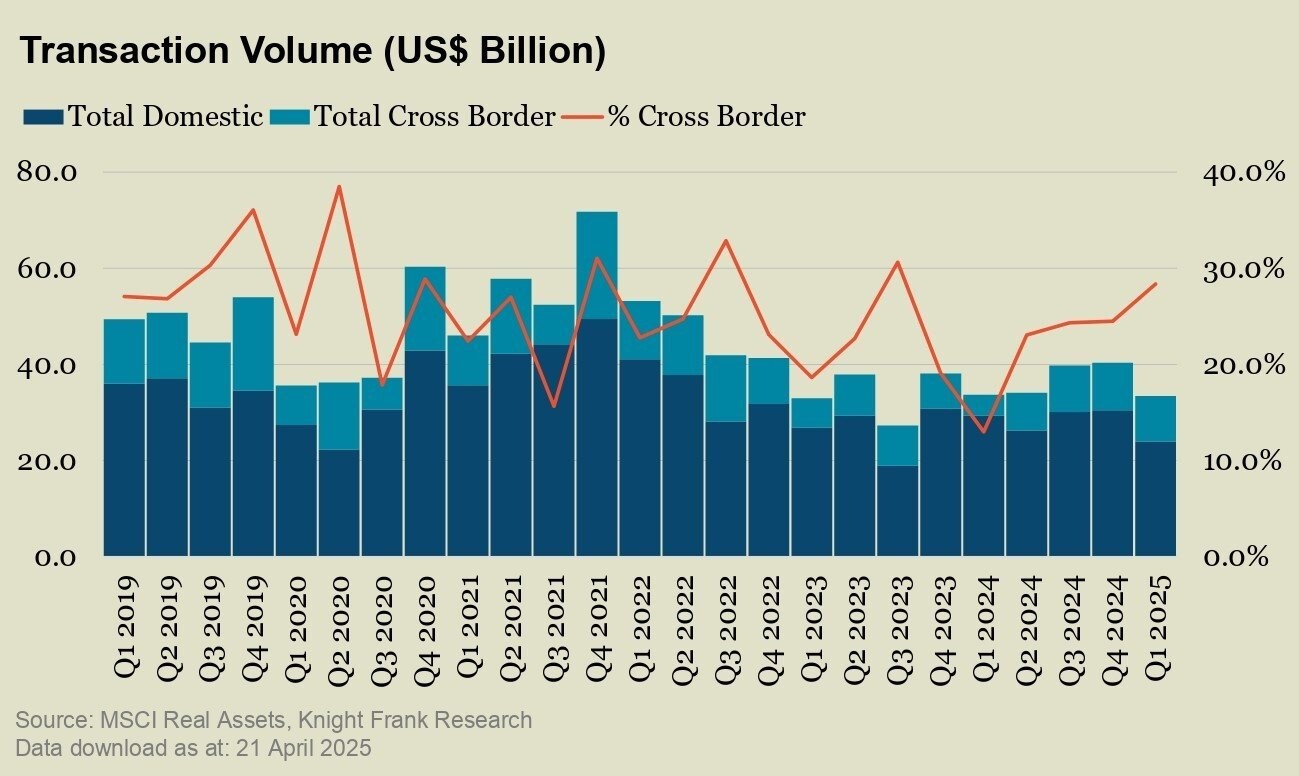

Overall transaction volume in Asia-Pacific held steady at US$33.4 billion in Q1 2025, the report finds, easing 0.8% from the same period last year. However, it showed a sharper 17.1% decline from the strong activity in Q4 2024. International investors remain active, with cross-border transactions accounting for 28.4% of all investment activity, the highest proportion since Q3 2023.

“Asia-Pacific’s real estate market held up well so far in 2025, with cross-border investment activity reflecting sustained interest, particularly in Japan, Australia, and South Korea,” says Craig Shute, the property group’s CEO for Asia-Pacific. “Stabilizing asset prices and the clear signal that interest rates have peaked encourage investors to support renewed capital deployment.

“As investors gravitate towards office, industrial and retail assets that offer resilient income and long-term growth potential, improved financing conditions and clearer valuation floors are helping to restore confidence across key markets.”

Record-breaking deal anchors quarter

Demonstrating sustained demand for high-quality assets, the report notes, Blackstone acquired the mixed-use Tokyo Garden Terrace Kioicho from Seibu Holdings for US$2.6 billion, the largest real estate acquisition by a foreign fund in Japan and the largest transaction in the region for the quarter.

Japan, South Korea and Australia have emerged as investor favourites in attracting international capital.

In Japan, investors strategically leverage unique market conditions, the report details, combining a depreciated yen, attractive financing rates and consistent market fundamentals. The office sector stands out with near-capacity occupancy levels reinforced by Japan’s established office-centric work culture.

Development constraints from escalating construction costs have created an advantageous supply-demand dynamic for existing owners. The retail sector also drew significant attention, highlighted by Gaw Capital and Patience Capital Group’s landmark US$1 billion-plus acquisition of Tokyu Plaza Ginza in Tokyo’s prime shopping district.

In South Korea, foreign investor confidence in the industrial sector has surged over the past year, with more acceptable interest rates, proven sector resilience and growing leasing activity amid limited prime supply.

In Australia, retail assets experienced a rebound, with investment volumes nearly tripling year-on-year to US$592 million. This renewal reflects improving economic sentiment as inflation and interest rate concerns ease and retail sales strengthen.

Positive momentum, tariff uncertainty

With US$5.6 billion in deals already captured in the first weeks of Q2 2025, the report points out, the market shows promising signs of continued growth. Central bank rate cuts have enhanced the attractiveness of debt-financed acquisitions, while stabilizing asset prices have fuelled increased market activity.

“While we anticipate this positive momentum to gather pace, the on-again, off-again tariffs are muddying the outlook for further recovery in the investment landscape,” shares Christine Li, Knight Frank’s head of research for Asia-Pacific. “Should tariffs lead to a sustained increase in inflation, the Fed would likely raise interest rates, exerting upward pressure on long-term interest rates and cap rates, potentially dampening capital markets activity globally.

“If implemented in full force, the industrial and retail sectors will likely bear the brunt, with decreasing consumer spending and shifting goods movement directly influencing demand.”

Despite the broader economic uncertainties, the office sector across Asia-Pacific, the report argues, demonstrates notable stability, protected by a unique combination of structural advantages and positive market cycles.

This is particularly evident, the report adds, in Japan and Australia’s premier cities, where high occupancy rates persist, alongside steady rental growth trajectories, even as other sectors face potential headwinds.